Alex Belov

Developers by oneinveststock.com. Analyst, investor

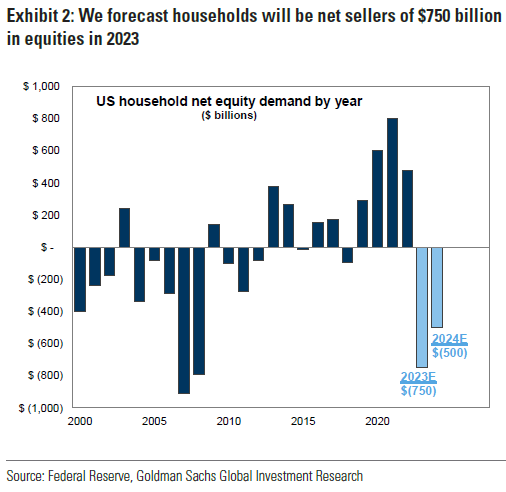

According to the investment bank, Goldman Sachs, US households’ net sales of stocks could reach $750 billion by 2023, which would be the highest level since 2008.

Goldman Sachs expects that in 2023, US households may sell more stocks than they buy for the first time since 2018. According to the bank’s base scenario, the difference would be $750 billion, Bloomberg reported.

This is the highest level since 2008, when the net sales volume was over $800 billion.

The bank explained that the decreasing popularity of stocks is due to the high yield in the bond market resulting from rising interest rates and the low savings rate among the population. At the same time, tightening monetary policy is negatively affecting stocks and reducing their investment attractiveness.

For example, by the end of 2022, when the Federal Reserve raised rates from nearly zero to 4.25-4.5% per annum, the S&P 500 index fell by nearly 20%. The rate is now at 4.75-5%, and the regulator allows for further increases.

US households were the main buyers of stocks in the period after the 2008 crisis when the US had soft monetary policy. However, since the rate has increased, private investors have become more cautious. Although US households still own 38% of shares in US public companies, investors are beginning to reject the idea that there are no alternatives to these instruments and are moving to other asset classes.

Even if the yield on bonds does not rise or even falls by the end of the year, US households will still become net sellers of stocks, not net buyers, according to Goldman Sachs analysts. According to their pessimistic forecast, by the end of the year, the volume of private investors’ sales of stocks may exceed the volume of purchases by $1.1 trillion. According to the optimistic forecast, which assumes a decrease in yield in the debt market and a higher savings rate than expected, the difference may be $400 billion.

Earlier, JPMorgan Chase warned of the risk of a “Minsky moment” against the backdrop of rising interest rates and market instability. Before the “Minsky moment,” investors actively use both their own and borrowed funds to buy assets, resulting in a debt burden and a bubble in the market. However, many borrowers subsequently become unable to repay their debts, and any destabilizing event can lead to a panic sale of purchased assets, causing a price collapse.

Developers by oneinveststock.com. Analyst, investor

You must be logged in to post a comment